What Does Project 2025 Say About IVF?

April 30, 2025

What Is the Cost of IVF? Your Complete Guide to Understanding the Price Tag

April 30, 2025What Insurance Covers IVF in New York: Your Ultimate Guide to Fertility Coverage

Starting a family can feel like a dream come true, but for many in New York, the journey to parenthood through in vitro fertilization (IVF) comes with a big question: Will my insurance help cover this? IVF can be a game-changer for those facing infertility, yet the costs—often ranging from $12,000 to $20,000 per cycle—can feel overwhelming. The good news? New York has some of the most progressive fertility insurance laws in the country, and understanding what’s covered can make all the difference.

In this guide, we’ll walk you through everything you need to know about insurance coverage for IVF in New York. From state laws to practical tips, we’ve got you covered with clear answers, real-life examples, and even a few fresh insights you won’t find anywhere else. Whether you’re just starting to explore your options or deep into the process, this article is your go-to resource for navigating the world of fertility insurance.

Why Insurance Coverage for IVF Matters in New York

IVF isn’t just a medical procedure—it’s a lifeline for many couples and individuals hoping to build a family. In New York, where the cost of living is already high, adding fertility treatments to the mix can feel like a financial mountain to climb. That’s where insurance steps in. Since 2020, New York has made huge strides in mandating coverage for IVF, but the details can get tricky.

Imagine this: Sarah and Mike, a couple from Brooklyn, spent years trying to conceive naturally. When they turned to IVF, they were shocked to learn a single cycle could cost more than their annual rent. Luckily, New York’s updated laws meant their insurance covered most of it, turning a stressful expense into a manageable step toward parenthood. Stories like theirs show why understanding your coverage is so important—it’s not just about money; it’s about hope.

So, what does insurance actually cover for IVF in New York? Let’s break it down.

New York’s IVF Insurance Mandate: The Basics

New York State took a bold step in 2020 with a law that requires certain insurance plans to cover IVF. This wasn’t just a small tweak—it was a major win for families, driven by years of advocacy from groups like RESOLVE: The National Infertility Association. Here’s what you need to know about the mandate:

- Who’s Covered? The law applies to large group insurance plans, meaning employers with 100 or more employees. If your job offers health insurance through a fully insured plan (not self-funded), you might be in luck.

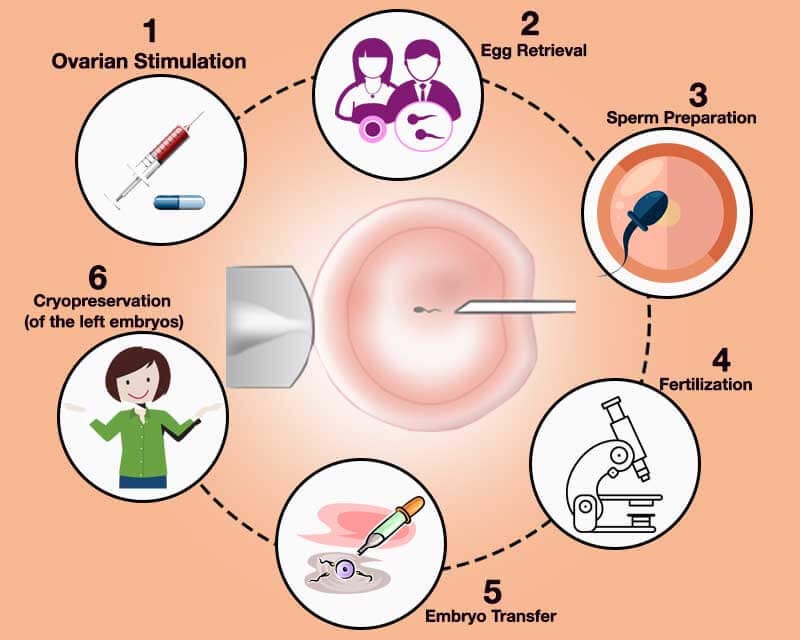

- What’s Covered? Up to three cycles of IVF are included, along with related medications if your plan covers prescriptions. A “cycle” includes everything from ovarian stimulation to embryo transfer—fresh or frozen.

- Who’s Left Out? Small group plans (under 100 employees), individual plans, Medicaid, and self-funded employer plans aren’t required to follow this mandate. That’s a gap that still affects many New Yorkers.

This law also bans discrimination based on age, sex, marital status, or sexual orientation, making it a lifeline for diverse families—like single parents or LGBTQ+ couples—who might need donor eggs or sperm. But there’s a catch: you need a medical diagnosis of infertility, typically defined as trying to conceive for 12 months (or 6 months if you’re over 35) without success.

How to Check If Your Insurance Covers IVF

Not sure if your plan includes IVF? You’re not alone—figuring this out can feel like decoding a secret message. Here’s a simple step-by-step guide to get clarity:

- Look at Your Policy: Grab your insurance handbook or log into your provider’s website. Search for terms like “infertility,” “IVF,” or “fertility treatments.”

- Call Your Insurance Provider: Dial the number on your insurance card and ask: “Does my plan cover IVF under New York’s mandate?” Be ready with your policy number—they’ll need it.

- Talk to HR: If you get insurance through work, your human resources team can tell you if your plan is fully insured (covered by the mandate) or self-funded (exempt).

- Consult a Fertility Clinic: Places like RMA of New York or NYU Langone Fertility Center have financial coordinators who can check your coverage for you—often for free.

Pro Tip: Don’t assume silence means “no.” Some plans cover IVF even if it’s not required by law, especially if your employer opts in voluntarily. For example, big companies like Google or Netflix sometimes offer fertility benefits to attract talent, even in self-funded plans.

Quick Quiz: Does Your Plan Cover IVF?

Take a minute to test your situation:

- ✔️ Do you work for a company with 100+ employees?

- ✔️ Is your insurance “fully insured” (not self-funded)?

- ✔️ Have you been diagnosed with infertility by a doctor?

If you checked all three, your plan likely covers IVF under New York law. If not, keep reading—there are still options!

What IVF Costs Look Like With and Without Insurance

Let’s talk numbers. IVF costs can vary wildly depending on where you go and what you need. Here’s a breakdown based on real data from New York clinics:

| Service | Cost Without Insurance | Cost With Insurance (Typical Co-Pay) |

|---|---|---|

| Initial Consultation | $300–$500 | $0–$50 |

| IVF Cycle (One Round) | $12,000–$20,000 | $500–$2,000 |

| Medications | $3,000–$7,000 | $50–$500 |

| Embryo Freezing/Storage | $1,000–$2,000/year | Often Covered (Up to 3 Cycles) |

Source: Estimates from RMA of New York, Genesis Fertility, and New Hope Fertility Center, adjusted for 2025 trends.

Without insurance, a single IVF cycle could drain your savings. With coverage, you’re looking at co-pays and deductibles—still a chunk of change, but way more doable. For instance, a 2023 study by FertilityIQ found that insured patients in mandate states like New York paid 70% less out-of-pocket than those without coverage. That’s a huge relief for families on a budget.

But what if your insurance doesn’t cover IVF? Don’t lose hope—there are creative ways to make it work.

Options If Your Insurance Doesn’t Cover IVF

If you’re in a small company, on Medicaid, or stuck with a self-funded plan, New York’s mandate might not apply to you. Here’s how to bridge the gap:

1. New York State Infertility Demonstration Program

This hidden gem offers grants to help cover IVF costs for insured patients whose plans don’t include it. You’ll need to:

- Be a New York resident.

- Have private insurance (not Medicaid).

- Meet medical criteria, like not having more than three failed IVF cycles already.

- Apply through an approved clinic, like RMA of New York or NYU Langone.

Sarah from our earlier example used this program after her employer’s self-funded plan left her high and dry. It cut her costs in half, making IVF possible.

2. Fertility Financing and Loans

Companies like Future Family or CapexMD offer low-interest loans tailored for IVF. Rates can start as low as 5%, and you can spread payments over months or years. It’s like financing a car—but for a baby!

3. Employer Advocacy

If your company doesn’t cover IVF, ask anyway. A 2024 survey by the Society for Human Resource Management found that 15% of small employers added fertility benefits after employee requests. Write a polite email to HR with stats—like how 1 in 8 couples face infertility—and you might spark a change.

4. Out-of-Pocket Discounts

Some clinics, like New Hope Fertility, offer package deals or discounts for self-pay patients. A mini-IVF cycle, which uses fewer meds, might drop to $6,500—half the usual price.

Fertility Preservation: A Bonus Coverage Perk

Here’s something not everyone talks about: New York’s law also covers fertility preservation—think egg or sperm freezing—when it’s medically necessary. This applies to all insurance plans, not just large groups. So, if you’re facing cancer treatment, gender-affirming surgery, or another procedure that could harm your fertility, your insurance has to step up.

For example, Jamie, a 29-year-old from Queens, froze her eggs before chemo for breast cancer. Her insurance covered the $10,000 process, including storage, because it was deemed “iatrogenic infertility” (caused by medical treatment). This perk is a lifesaver for young New Yorkers planning ahead.

Poll: What’s Your Next Step?

What are you most curious about after reading this?

- A) Checking my insurance coverage

- B) Exploring financing options

- C) Learning more about fertility preservation

- D) Talking to my employer about benefits

Drop your answer in your head (or share it with a friend)—it’ll help you focus your next move!

The Gaps in Coverage: What’s Still Missing

New York’s law is a big step forward, but it’s not perfect. Here are three gaps you won’t find fully explored elsewhere—and why they matter:

1. No Coverage for Elective Egg Freezing

Want to freeze your eggs just because you’re not ready for kids yet? That’s not covered, even though it’s a growing trend. A 2024 report from the American Society for Reproductive Medicine (ASRM) found that elective egg freezing in New York spiked 20% since 2020, yet insurance won’t touch it unless it’s medically necessary. Clinics charge $6,000–$11,000 for this, leaving many women to foot the bill.

2. Limited Support for Donor Cycles

If you need donor eggs or sperm—common for older patients or same-sex couples—the mandate covers your IVF cycles, but not always the donor costs. These can add $5,000–$15,000 per cycle. A proposed bill, “The Equity in Fertility Treatment Act” (2023), aims to fix this, but it’s still pending as of April 2025.

3. Self-Funded Plans Dominate Big Employers

Here’s a twist: 60% of large employers in the U.S. use self-funded plans, according to a 2024 Kaiser Family Foundation study. In New York, that means even if you work for a big company, you might miss out on the mandate. It’s a loophole that frustrates advocates and patients alike.

Real Stories: How New Yorkers Navigate IVF Coverage

Let’s meet a few folks who’ve been through this:

- Lisa, 34, Manhattan: Her large-group plan covered three IVF cycles, but she hit a snag when her meds weren’t fully covered. She switched pharmacies to one in-network and saved $2,000.

- Carlos, 41, Rochester: His small employer didn’t offer IVF coverage, so he tapped the Infertility Demonstration Program. It took extra paperwork, but he got a $7,000 grant.

- Priya, 28, Albany: Facing endometriosis surgery, she froze her eggs under the preservation clause. Her insurance covered it all, giving her peace of mind.

These stories show that while the system isn’t flawless, there’s room to make it work for you.

Tips to Maximize Your IVF Coverage

Ready to take charge? Here are some insider tricks to get the most out of your insurance:

✔️ Get Pre-Authorization: Some plans require approval before IVF starts. Ask your clinic to handle this—it’s their specialty.

✔️ Use In-Network Providers: Stick to doctors and pharmacies your insurance likes to avoid surprise bills.

✔️ Appeal Denials: Denied coverage? Fight back with a letter from your doctor. A 2023 ASRM study found 30% of appeals succeed.

❌ Don’t Skip the Fine Print: Missing a deadline or form can delay everything. Stay on top of it.

✔️ Tap HSAs/FSAs: Health savings or flexible spending accounts can cover co-pays tax-free—check with your employer.

The Future of IVF Coverage in New York

What’s next? New York’s fertility laws are evolving. The “Equity in Fertility Treatment Act” could expand coverage to donor cycles and tweak the infertility definition to include more people—like those who can’t conceive without medical help, regardless of time spent trying. Advocates are also pushing to close the self-funded loophole, though that’s a tougher battle.

On the flip side, costs are a concern. The New York Department of Financial Services estimated in 2019 that IVF mandates would bump premiums by 0.5%–1.1%. That’s small, but insurers argue it adds up. Still, a 2024 study in Reproductive Biology and Endocrinology found that states with IVF mandates see higher birth rates and lower long-term healthcare costs—proof that investing in fertility pays off.

Your IVF Action Plan: Where to Start

Feeling overwhelmed? Here’s a simple roadmap to kick things off:

- Today: Call your insurance provider and ask about IVF coverage. Jot down what they say.

- This Week: Book a consultation with a fertility clinic—they’ll double-check your benefits and explain your options.

- Next Month: If you’re not covered, research grants or financing. Start small—every step counts.

And if you’re still unsure, talk to someone who’s been there. Online forums like Reddit’s r/infertility or local support groups in New York can connect you with real advice.

Final Checklist: Are You Ready for IVF?

Before you dive in, run through this:

- ✔️ I’ve checked my insurance coverage.

- ✔️ I know my out-of-pocket costs.

- ✔️ I’ve explored grants or loans if needed.

- ✔️ I’ve picked a clinic I trust.

All set? You’re on your way to making your family dreams a reality.

Wrapping Up: Your Path to Parenthood

Navigating insurance for IVF in New York can feel like a maze, but it’s worth the effort. With the state’s mandate, preservation coverage, and extra resources like grants, you’ve got more tools than ever to make this work. Sure, there are gaps—elective freezing, donor costs, and self-funded plans—but the landscape is shifting in your favor.

Think of it like planting a garden: it takes time, care, and a little digging, but the results can be beautiful. Whether you’re covered or carving your own path, you’re not alone. New York’s got your back, and so do we. So, take that first step—call your insurer, chat with a clinic, or just dream a little bigger. Your family story starts here.